|

|

July 5, 2023

Chandra Ghimire, Smruti S. Pattanaik and Ashish Banik

Abstract:

This Policy Brief examines the challenges and prospects related to sub-regional trade and transit involving India, Nepal, and Bangladesh. Eastern South Asia holds significant potential for economic cooperation and integration due to their geographic proximity and complementary resources. However, several obstacles hinder the realization of this potential.

The key challenges faced by the three nations in promoting trade and transit include inadequate infrastructure, bureaucratic complexities, negative perception of certain political parties of Nepal and Bangladesh on India, and poor regional connectivity. Despite these challenges, the region has immense opportunities for enhanced trade and transit cooperation between these countries. Furthermore, the study discusses the potential benefits of improving infrastructure, streamlining customs procedures, and harmonizing regulations to facilitate trade and transit within the sub-region.

By addressing the challenges and harnessing the prospects, India, Nepal, and Bangladesh can unlock the subregion's economic potential, promote regional stability, and contribute to their respective development agendas.

Introduction

Trade and transit issues play a crucial role in shaping the economic relationships between countries, facilitating the movement of goods, and driving economic growth. The trade and transit dynamics among India, Nepal, and Bangladesh have significant implications for their respective economies and regional integration. Most importantly, while India aspires to take its neighbours along and share the benefits of economic growth, such trading connectivity being pushed at a sub-regional level would play a vital role for Bangladesh, which would be graduating from the Least developed countries (LDC) to the moderately developing counties in the near future, and Nepal. India also understands that its economic growth and prosperity are very much linked to its friendly relationship and stability in the neighbourhood and a regional platform would expedite the process of reaching out to the smaller neighbours, especially over those matters, which could not be achieved bilaterally.

Nepal, being a landlocked country, heavily relies on transit routes through neighbouring countries for its international trade. Despite the fact that Nepal is having a trade and transit agreement with China since 2016, India serves as its primary transit route for trade followed by Bangladesh. In recent years, efforts have been made to enhance trade and transit cooperation among Nepal, India, and Bangladesh, recognizing the potential for economic integration and mutually beneficial partnerships. Bilateral trade agreements, transit agreements, and regional initiatives have been pursued to foster greater economic engagement and remove barriers to trade. Nonetheless, various challenges, such as trade imbalances, non-tariff barriers, infrastructure gaps, and differing regulatory frameworks, persist and require concerted efforts to address.

This Policy Brief aims to explore the current state of trade and transit issues among Nepal, India, and Bangladesh, and shed light on the opportunities, challenges, and ongoing initiatives that impact the economic relationships between these countries. By examining the trade volumes, major commodities, transit routes, and policy frameworks, a comprehensive understanding of the trade and transit dynamics in the region can be useful as a step towards faster regional integration. Additionally, it is essential to identify potential areas of collaboration and strategies to overcome the existing obstacles, fostering a more seamless and mutually beneficial trade and transit environment between these countries.

Physical connectivity: The first step

Transport connectivity has been a panacea for economic development, encouraging more trade, and market integration. Moreover, it is deemed as a precondition for prosperity and growth. Therefore, it is not surprising that most of the governments in South Asia have been eager to develop transport networks. In this context, Motor Vehicle Agreement (MVA) has assumed importance to make this connectivity operational.

While the Asian Highway and Railway network has got a push, initiatives within the region like the SAARC MVA, BIMSTEC MVA, and Bangladesh-Bhutan-India-Nepal (BBIN) MVA have received the attention of policymakers. In the past few years, India has prioritised BIMSTEC and BBIN MVA as SAARC MVA did not move forward in the Kathmandu summit in 2014. The BBIN-MVA has also not taken off primarily because of pushback from Bhutan.

India’s earlier ‘Look East’ and now ‘Act East’ policy has provided significant impetus to sub-regional cooperation. Over a period of time, India has invested more than US billion in Bangladesh as part of its line of credit to restore the connectivity network that existed prior to the partition of India. It was only after the liberation of Bangladesh that the waterways opened up, although transit through Bangladesh territory could not start for mainly political reasons. Providing transit to India was securitised and many in Bangladesh opposed this idea. In 2011, India extended a billion credit line to invest in infrastructure.

In 2015, India and Bangladesh signed an MoU for the movement of goods to and from India[1] using Chittagong and Mongla ports. In 2016, Bangladesh announced a transit facility for India at 192 taka which India has been lobbying for a long time. India has announced Bharatmala Pariyojana, which is aiming at improving the Border and international connectivity roads spanning about 5300 km to improve connectivity and trade with Nepal, Bhutan, Bangladesh, and Myanmar, which is being funded by Asian Development Bank.[2]

With Nepal and Bhutan; India was engaged in developing a connectivity network not within the country but linking these to India; notable among them was the East-West highway and several other road projects[3] in Nepal’s Terai region and project DANTAK in Bhutan.[4] Considering these two Himalayan countries’ poor connective infrastructure in the 1950s, India’s partnership programme began with developing both road connectivity and air connectivity.

For India, sub-regional transport corridors will help in the development of the North Eastern region as well as connect India to the markets in South East Asia.

Optimising Cross Border trade

Several modern integrated land ports with parking facilities are being developed to facilitate trade, reduce waiting time for trucks and help in quick loading and unloading of products. Apart from these, Port Automation System, Land Port Digital Security and Monitoring System, Digital Port Asset Management System and Suvidha Portal, which is a West Bengal initiative in coordination with customs and Border Security Force (BSF), are introduced to decongest the land ports. Many of these digital clearance, authorisation and payments were introduced in 2016 as RAPID scheme. According to a media report, “Single Window Interface for Facilitation of Trade (SWIFT) was introduced to replace nine separate documents into import declaration, integrated risk assessment and electronic clearance from Partner Government Agencies and introduced an online document repository (eSANCHIT) in 2018”.[5] No objection certificate for live consignment from six agencies is now being handled through single import declaration and the online clearance facility since 2016.[6]

The Land Port Management system would introduce several features like unified payment, record shipment details of cargo/container management, online filing of custom clearance, warehouse and yard management, slot management, full body truck scanners, and vehicle dwell time forecast which will improve the trade.[7] These facilities are likely to be replicated in Ghojadhanga, Mahadipur, Hili, Changrabandha, and Fulbari borders along the Indo-Bangladesh and Indo-Nepal border of West Bengal.

(a) India and Bangladesh

The successful use of container cargo using the India-Bangladesh protocol routes (IBPR) is a case in point as waterways remain the cheapest mode of transportation.[8] Adani Ports Limited was the first company to use containerised cargo through the IBPR to send sponge iron to Pangaon International Container Terminal Dhaka in July 2020.[9] In 2022 first EXIM cargo[10] was sent to Bangladesh by Maersk. India has allowed the Indian railway to carry Bangladesh exports to India in “sealed containers that are returning to India by rail after delivering export goods to Bangladesh”.[11] India has consented to Nepal’s use of three waters ways[12] for its trade. (i) Kolkata-Kalughat, Raxaul; (ii) Kolkata-Sahebgunj, Biratnagar; and (iii) Kolkata-Varanasi-Raxaul.

(b) India and Nepal

India has signed the Rail Services Agreement in 2004 with Nepal to introduce freight train service between Birgunj and Raxaul. In December 2008 new Customs procedures were agreed through ‘Letter of Exchange’ (LoE) to operationalise the 2004 agreement. In 2016, the two countries enabled rail transit traffic to/from Vishakhapatnam Port in addition to the existing provision of rail transportation through Kolkata/Haldia Port. In July 2021, in a significant move, the two countries signed a ‘Letter of Exchange’ formalising, “all cargo train operators to utilize the Indian railway network to carry all containers bound for Nepal whether bilateral freight between India and Nepal or third country freight from Indian ports to Nepal.”[13] Following this agreement, private players[14] from India have started delivering goods from Haldia to Birgunj. India is building five major Integrated Check Posts at Birgunj-Raxaul, Biratnagar-Jogbani, Bhairahawa-Sunauli, Nepalgunj-Rupaidiha, and Dodhara Chandani.

(c) India and Bhutan

In November 2016, Bhutan also signed Agreement on Trade, Commerce, and Transit, which introduced free trade between the two countries. In Alipurduar in Hasimara, Northeast Frontier Railway is developing infrastructure to promote cross-border trade with Bhutan. This line is supposed to connect Bhutan to Bangladesh via Changrabanda railway station[15] in Cooch Behar which is closer to the Bangladesh route. This can be further connected to Burimari stations in the Haldibari-Chilahati route.[16] Bangladesh has already opened up Mongla, Payra and Chittagong ports for trade to the BBIN countries. These ports will be in addition to the Indian ports.

It is not surprising that these measures helped India to make a quantum jump in the global ranks in ‘Trading across Borders’ from 146 in 2017 to 80 in 2018 and 68 in 2020.[17] Going further, India has been ranked 38 out of 139 countries in the 7th edition of Logistics Performance Index (LPI 2023).[18] All these achievements demonstrate that India has taken steps, in the past decade, to improve both physical and digital infrastructures. According to a World Bank report, although trade between the BBIN countries grew six-fold between 2005 and 2019, the unexploited potential remains massive, estimated at 93 percent for Bangladesh, 50 percent for India, and 76 percent for Nepal.[19]

Over a period of time connectivity has improved and Bangladesh has opened up its ports for use by Nepal and Bhutan. Nepal is now using the Bangalabandha Dry Port, an inland intermodal terminal directly connected by road or rail to the seaport of Chittagong through which Nepal exports its polyester yarns. Similarly, Eastern Waterways Grid, which is being developed by India, will connect Nepal and Bhutan with Bangladesh. Bhutan is already trading with Bangladesh using Brahmaputra protocol route. India has agreed to this sub regional transit arrangement and allows transit facilities to both Nepal and Bhutan; trade-related congestions near the border are also being eased out. Trade within this sub-region has grown but it is yet to achieve its potential as procedures for trade need to be further simplified and waiting time at the border requires to be drastically reduced. The following table captures the current trade that India has with its South Asian neighbours.

Table-1: India’s Trade with South Asian Countries

US$ million

|

|

India’s Export |

India’s Import |

|||||

|

|

Countries |

2021-22 |

2022-23 |

% growth |

2021-22 |

2022-23 |

% growth |

|

1. |

Afghanistan |

554.47 |

437.05 |

-21.18 |

510.93 |

452.81 |

-11.38 |

|

2. |

Bangladesh |

16,156.37 |

12,203,93 |

-24.46 |

1,977.93 |

2021.24 |

2.19 |

|

3. |

Bhutan |

885.81 |

1,070.37 |

20.84 |

545.04 |

535.61 |

-1.73 |

|

4. |

Maldives |

670.40 |

476.75 |

-28.89 |

68.93 |

496.62 |

620.49 |

|

5. |

Nepal |

9,645.74 |

8,015.99 |

-16.90 |

1,371.04 |

639.62 |

-38.76 |

|

6. |

Pakistan |

513.82 |

627.10 |

22.04 |

2.54 |

20.11 |

692.71 |

|

7. |

Sri Lanka |

5,802.18 |

5,111.59 |

-11.90 |

1,009.97 |

1078.14 |

6.75 |

|

|

Total |

34,228.80 |

27,942.76 |

-18.36 |

5,486.37 |

5444.14 |

0.77 |

|

|

India's Total |

422,004.40 |

450,958.43 |

6.86 |

613,052.04 |

714,042.44 |

16.47 |

|

|

% Share |

8.1110 |

6.1963 |

|

0.8949 |

0.7624 |

|

Source: Ministry of Commerce, Government of India, https://tradestat.commerce.gov.in/eidb/ergncnt.asp

Table-2: Break-up of bilateral trade with land ports during 2022-23 (Q1-Q2, September-April)

Total trade through the land port is INR 39,394.46 Cr. Nepal and Bangladesh are the top trade partners of India with a percentage share of 47% and 42% respectively.

Source: Land Ports Authority of India, Department of Border Management, Ministry of Home Affairs, Government of India, https://lpai.gov.in/sites/default/files/2023-01/Gateway_to_India_3rd%20edition_0.pdf. P.7

A Nepali Perspective

While India has contributed substantially to facilitate regional trade with its immediate neighbours over the decades, the neighbours have different perspectives on that and often feel that India’s efforts are more India-centric than for the benefit of others. Trade and Transit issues have been one of the major irritants in India-Nepal bilateral relations and Nepal often expects special treatment on this issue as a landlocked country. Nepal is not convinced that the transit facilities offered by India are sufficient for its rapid economic growth. As a landlocked country, it is committed to working towards reducing the cost and time progressively. It is entitled to the rights and privileges established by the UN Convention on Law of Sea (1982) for landlocked states under articles 124-132.

Nepal also aims at export-led growth to attain sustainable economic development. The country has passed through several modes of liberalization, reforms, and rationalization of tariffs. Since its accession into the WTO, the country has committed itself to seventeen agreements associated with the Marrakesh Agreement (1994) and tuned its policies to SAFTA (2006). It has also signed seventeen bilateral agreements including Free Trade Agreement (FTA) with India. Nevertheless, the outcome of trade liberalization has not been according to its expectations.

In bilateral arrangements, transit treaties with India, Bangladesh, and China are in-effect. Despite these arrangements, the country incurs high costs and time both in its imports and exports. As an LLDC, Nepal requires an economical and efficient transit transport system for the expansion of trade and economic development.[20]

Current bilateral and sub-regional trade

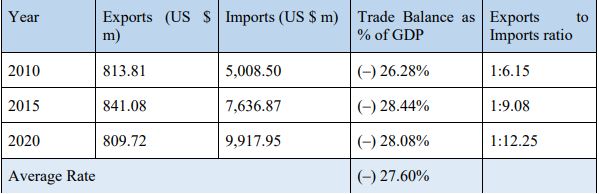

Nepal’s economy is hampered by the external sector (imbalanced trade). Table 3 depicts that trade balance to GDP has remained negative with an average of 27.60 percent in 2010, 2015, and 2020. The exports to imports ratio increased from 1:6.15 in 2010 to 1:12.25 in 2020. These epitomize the country's weak trade performance.

Table-3: Nepal's Overall Trade Performance

Source: Author's calculations based on data from Direction of Foreign Trade Series, TEPC, 2010-2020.

Similarly, Table-4 shows that Nepal has performed badly compared to Bangladesh, Bhutan, and India. In FY 2021, Nepal's trade GDP ratio stood at 44 percent, and, the export-to-GDP ratio, at 5.2 percent. In comparison, the same figures for Bangladesh, Bhutan, and India stood at 10.7, 31.8, and 21.4 percent, respectively. On average, the cumulative figure for BBIN countries stands at 17.2 percent, which leaves Nepal far below.

Table-4: Overall Trade Performance of BBIN Countries in 2021

Source: Author's calculations based on data from the World Bank database.

Table 5, given below, provides data on Nepal's trade with BBIN and non-BBIN countries, where Nepal's trade in goods with Bhutan has reduced from 0.329 percent in 2010 to 0.063 and 0.080 percent in 2015 and 2020, respectively. With Bangladesh, the trade size contracted from 1.195 percent in 2010 to 0.433 and 0.384 percent in 2015 and 2020 respectively. Its trade with India has improved slightly from 64.887 percent in 2010 to 64.909 percent in 2020.

Comparing Nepal's total trade with the BBIN countries, there is an increase between 2010 and 2020, from 64.887 to 64.909 in percentage terms. Similarly, the country's trade with non-BBIN countries has increased from 35.113 percent in 2010 to 35.091 percent in 2020. The presence of the ‘India’ factor is important in this whole process. Additionally, it appears that the integration of Nepal into the BBIN is an unfulfilled project at least in trade.

Table-5: Nepal's Trade in Goods with the BBIN and the Non-BBIN Countries (in percent)

Source: Author's calculations based on data from the Direction of Trade Statistics (DOTS), IMF.

Table 6 offers a comparative trend of total intra-BBIN trade; highest at the level of 4.507 percent in 2020. In the preceding years 2010 and 2015, it stood at 2.453 and 3.206 percent respectively in the total intra-sub-regional trade. It is striking that almost 95 percent of it is traded with non-BBIN partners. Hence, ample interventions are required for changing this trend.

Table-6: Total Non-BBIN and Intra-BBIN Trade in Goods (in percent)

Source: Author's calculations based on data from the Direction of Trade Statistics (DOTS), IMF.

In many cases, Nepal pays ironically higher costs while trading with countries in the sub-region than while dealing with distant countries. For India, the cost seems relatively much lesser. For the sub-regional initiative to take off, and the trend to be reversed, all the BBIN countries and especially, India, need to do more.

When it comes to trade facilitation, except Bhutan, other BBIN countries have various provisions resulting in high costs and time drags in exports and imports. That is why South Asian countries have not been able to realise their trade potential. Nepal requires the highest level of documentary and border compliance with both India and Bangladesh (see Tables 7 and 8), which affects its external trade.

Table-7: Time Required to Import[21]

Source: Doing Business, World Bank, 2020 derived from Alam, M. Absar (2021).

Table-8: Time Taken to Export

Source: Doing Business, WB, 2020 derived from Alam, M. Absar (2021).

A Bangladeshi Perspective

Bangladesh has positioned itself as a key hub for enhancing connectivity across Eastern South Asia and beyond, owing to its advantageous geostrategic location and sustained economic growth. The country has made significant investments in establishing extensive infrastructure and efficient logistical systems in major land and sea ports nationwide. These endeavors aim to bolster competitiveness, promote efficiency, and foster sub-regional as well as regional connectivity.[22]

As Bangladesh progresses towards achieving developing country status by 2026, its economy faces a distinct set of prospects and challenges. Sustaining the current momentum of economic development and progress requires a strategic approach that includes diversifying export portfolios and expanding access to new markets both domestically and internationally. The country is committed to fostering reciprocal and equitable relationships, and aims to promote trade and transit cooperation with its neighboring nations. However, Bangladesh acknowledges the complexity of addressing trade and transit barriers at the national and regional levels. Consequently, it highly values collaborative efforts from all stakeholders, be they state or non-state actors, to advance the trade and transit agenda, whether at the sub-regional or regional level.

Trade with India and Nepal

The trade volume between Bangladesh, India, and Nepal has witnessed recent growth. However, the potential for even greater expansion remains untapped, primarily due to the absence of seamless connectivity among these nations. Realizing this untapped potential would require the establishment of robust and efficient connectivity infrastructure. Having said that, there are certain variations in the trends of exports and imports of these countries, which are depicted in the figure in Table 9. For example, despite the significant increase in Bangladesh’s export to the Indian market, the trade deficit particularly with India remains a concern for Bangladesh. During the last 26 years, the exports of India to Bangladesh have increased at an annualized rate of 10.5%, from .04 billion in 1995 to .10 billion in 2021, which makes Bangladesh India’s fifth biggest export destination.[23] There is also a persistent trend that every year, Bangladesh's trade gap with India has been widening at an unprecedented scale. In FY 2021-22, for example, Bangladesh’s total import was worth US.58 billion from India, while its exports to that country were valued at a mere US.99 billion. In the fiscal year 2020-21, on the other hand, the figures were US.69 billion (import) and US.09 billion (export) respectively.[24]

To address this issue and foster mutually beneficial outcomes, the India-Bangladesh Joint Economic Commission (JEC) was established as a platform for regular communication and collaboration on trade and economic matters. However, trade between Bangladesh and Nepal has faced challenges, with Nepal experiencing a recent trade imbalance. The volume of trade between the two countries has been significantly lower, and the growth rate has remained minimal (as indicated in Table 9). Nevertheless, there is potential for growth in Nepal's exports to Bangladesh, particularly with the recent lifting of the two-decade-long ban on Nepali yarns entering Bangladesh via the Banglabandha Land Custom Station (LCS) in December 2022, an action taken by the Bangladesh Government. This development opens up opportunities for increased yarn exports from Nepal to Bangladesh.[25]

Table-9: Bangladesh’s Import from and Export to India and Nepal

|

|

Export to India and Nepal |

Import from India and Nepal |

||

|

Fiscal Year |

India (USD in billion) |

Nepal (USD in million) |

India (USD in billion) |

Nepal (USD in million) |

|

2021-22 |

1.99 |

68 |

14.58 |

4.80 |

|

2020-21 |

1.09 |

54 |

9.69 |

5.4 |

|

2019-20 |

1.10 |

48.6 |

5.79 |

12.10 |

|

2018-19 |

1.25 |

38.04 |

7.68 |

9.80 |

Source: Bangladesh Bank, Foreign Trade Statistics of Bangladesh and Nepal Embassy in Bangladesh.

Challenges

Future of BBIN

In recent years, India's Act East policy has presented numerous opportunities for connecting Northeast India with its neighbouring countries. The BBIN (Bangladesh, Bhutan, India, Nepal) initiative serves as a testament to the attractiveness of cooperation in Eastern South Asia. Efforts are underway to upgrade railway links in Bangladesh with the support of Indian line of credit. Moreover, India is actively engaged in linking Nepal to its railway network, which holds great potential for enhancing trade and connectivity between the two nations.

With the advent of digitalization, containerized cargo equipped with electronic locking systems will significantly facilitate cross-border trade. The linking of BBIN countries through waterways and road transport, along with the connection of electricity grids to enable cross-border electricity trade, holds great potential for boosting trade and fostering people-to-people contact within the region. Despite progress, transit through roadways remains a major challenge, despite the existence of an agreement on the operation of passenger vehicles between India and Bangladesh since 1999.[31]

The BBIN MVA was delayed due to the withdrawal of Bhutan from the same and re-joining the same as an observer. However, as India continues to improve border infrastructure, trade facilitation, and digitized document submission, the potential for further enhancing sub-regional cooperation should not be underestimated. India can serve as a crucial transit route for Bangladesh, Nepal, and Bhutan to engage in trade with one another. Similarly, Bangladesh is actively preparing itself to become a prominent transit hub. Japan, which is constructing a deep-sea port in Matarbari, Bangladesh, has expressed its intention to develop this port into a major commercial hub. Prime Minister Fumio Kishida of Japan has proposed a Bay of Bengal-Northeast India industrial value chain that would not only spur growth in India's north-eastern region but also enhance connectivity with Nepal and Bhutan through a proposed supply chain, with Matarbari playing a crucial role in this endeavour.

In summary, BBIN, initially conceived as a sub-regional cooperation framework, has the potential to grow and become a successful model of sub regional cooperation that benefits all member countries. It presents a win-win proposition, offering opportunities for enhanced collaboration, mutual benefits, and shared prosperity among the participating nations.

Recommendations

***

The views expressed by the authors in the policy brief are personal. That does not reflect their respective countries’ or institutions’ positions.

[1] MoU between the Ministry of Shipping, Road Transport and Highways Government of the Republic of India and the Ministry of Shipping Government of the People's Republic of Bangladesh, for details see ttps://www.mea.gov.in/Portal/LegalTreatiesDoc/BG15B2423.pdf (accessed on 12 June 2023).

[2] Projects Funded by Asian Development Bank, Ministry of Road Transport & Highways, Government of India, Press Information Bureau, 12 March 2018. For details see Projects Funded by Asian Development Bank (pib.gov.in) (accessed on 12 June 2023).

[3] Embassy of India, Kathmandu, Nepal: About Development Partnership (indembkathmandu.gov.in) “About Development Partnership” in the Embassy of India, Kathmandu, website. For details see Embassy of India, Kathmandu, Nepal: About Development Partnership (indembkathmandu.gov.in) (accessed on 12 June 2023).

[4] Project DANTAK completes 60 years in Bhutan, Ministry of Defence, India, PIB, 26 April 2021. For details see Press Information Bureau (pib.gov.in) (accessed on 12 June 2023).

[5] Ananth and Gaurav Masaldan, “Indian Customs digital journey,” The Hindu Businessline, 01 May 2022, Indian Customs digital journey - The Hindu BusinessLine (accessed on 12 June 2023).

[6] Single Window Interface for Facilitating Trade (SWIFT), SWIFT - Single Window Interface for Facilitating Trade (icegate.gov.in), (accessed on 12 June 2023).

[7] “Digital Transformation”, Land Ports Authority of India, Ministry of Home Affairs, Digital Transformation | Land Ports Authority of India (lpai.gov.in) (accessed on 12 June 2023).

[8] Two stretches of Bangladesh inland waterways viz. Sirajganj–Daikhawa & Ashuganj-Zakiganj on the IBP route are being developed at a total cost of Rs 305.84 Cr. on 80:20 cost sharing basis (80% being borne by India & 20% by Bangladesh). “First ever movement of container cargo on Brahmaputra (National Waterway -2)”, Press Information Bureau, 06 November 2019, https://pib.gov.in/newsite/PrintRelease.aspx?relid=194209 (accessed 27 June 2023).

[9] First Container Vessel Carrying Export Cargo from India to Bangladesh, Adani Ports and Logistics, origin-webapp.adaniports.com/newsroom/media-releases/2020_07_13-first-container-vessel-carrying-export-cargo-from-india-to-bangladesh, (accessed on 12 June 2023).

[10] “India set to sail containerised EXIM cargo to Bangladesh from IBP for the first time: Govt”, Press Release 1.pdf (sagarmala.gov.in) (accessed on 12 June 2023).

[11] CBIC to Allow Import of Bangladesh Goods via Returning Rail Cargo, South Asia Subregional Economic Cooperation, 17 May 2022, CBIC to Allow Import of Bangladesh Goods via Returning Rail Cargo | News | South Asia Subregional Economic Cooperation (sasec.asia) (accessed on 12 June 2023).

[12] Dipanjan Roy Chaudhury, “India to allow Nepal use of three rivers for inland waterways to push regional connectivity”, The Economics Times, 07 October 2019, India to allow Nepal use of three rivers for inland waterways to push regional connectivity - The Economic Times (indiatimes.com) (accessed on 12 June 2023).

[13] Rail Cargo movement between India and Nepal gets a big boost, Ministry of Railways, India, PIB, 09 July 2021, Press Information Bureau (pib.gov.in) (accessed on 12 June 2023).

[14] “First private cargo train arrives in Nepal from India”, ET Infra.com, 16 September 2021, India Cargo Train To Nepal: First private cargo train arrives in Nepal from India, ET Infra (indiatimes.com) (accessed on 12 June 2023).

[15] “Bhutan Discusses Trade Linkages via Railway with Indian Railways Officials” South Asia Subregional Economic Cooperation, 09 November 2022, Bhutan Discusses Trade Linkages via Railway with Indian Railways Officials | News | South Asia Subregional Economic Cooperation (sasec.asia) (accessed on 12 June 2023).

[16] “Bhutan eyes Bangla trade routes via Indian Railways”, The Times of India, 09 November 2022, Bhutan Eyes Bangla Trade Routes Via Indian Railways | Kolkata News - Times of India (indiatimes.com) (accessed on 12 June 2023).

[17] Doing Business, The World Bank, https://archive.doingbusiness.org/en/data/exploreeconomies/india#DB_tab (accessed on 12 June 2023).

[18] “India jumps 6 places to Rank 38 in World Bank’s Logistics Performance Index 2023”, Ministry of Commerce & Industry, India, BIP, 26 April 2023, Press Information Bureau (pib.gov.in) (accessed on 12 June 2023).

[19] Shomik Mehndiratta and Erik Nora, “What will it take to connect the Bangladesh, Bhutan, India, Nepal (BBIN) sub-region?” World Bank Blogs, January 24, 2022, at https://blogs.worldbank.org/endpovertyinsouthasia/what-will-it-take-connect-bangladesh-bhutan-india-nepal-bbin-sub-region (accessed on 27 June 2023).

[20] AK Shrestha and the Staff, “Transit Treaty Provisions and Their Impact on Nepal’s Transit Traffic Costs, Project on Logistics-UNDP/UNCTAD, NEP/82/002, 1984, p. 1.

[21] M. Absar Alam, “BBIN Motor Vehicles Agreement Scope for developing integrated logistics and transport infrastructure and other related services”, Discussion Paper, 2021, Cuts International, Jaipur, Rajasthan, India. For further details visit https://cuts-citee.org/pdf/discussion-paper-bbin-motor-vehicles-agreement.pdf (accessed 27 June 2023).

[22]“Bangladesh Development Update Moving Forward: Connectivity and Logistics to Strengthen Competitiveness”, The World Bank, Dhaka, April 2021. For details see https://pubdocs.worldbank.org/en/208851617818495059/Bangladesh-Development-Update-Spring-2021.pdf (accessed on 27 June 2023).

[23]Rajeev Jayaswal and Rezaul H Laskar, “Bangladesh is now among India’s top 5 export destinations”, The Hindustan Times, 24 May 2023, at https://www.hindustantimes.com/india-news/bangladesh-is-now-among-india-s-top-5-export-destinations-101623868511464.html (accessed on 27 June 2023).

[24] “Reducing Bangladesh's trade gap with India” Editorial, The Financial Express, 21 October 2022, https://thefinancialexpress.com.bd/editorial/reducing-bangladeshs-trade-gap-with-india-1666279118 (accessed on 27 June 2023).

[25] Nepal Embassy in Bangladesh, https://bd.nepalembassy.gov.np/trade/ (accessed on 27 June 2023).

[26] Mohammad Mohiuddin Abdullah, “Regional connectivity: Problems and prospects”, The Daily Star, 21 September 2011, https://www.thedailystar.net/news-detail-203266 (accessed on 27 June 2023).

[27] Shruti Vijayakumar and Mitali Nikore, “Turning it around: How India’s busiest land port also became its most efficient”, Wold Bank Blogs, 30 March 2023, https://blogs.worldbank.org/transport/turning-it-around-how-indias-busiest-land-port-also-became-its-most-efficient (accessed on 27 June 2023).

[28] Pratim Ranjan Bose, “24X7 Customs clearing fails to boost trade at Petrapole”, The Hindu Businessline, 07 December, 2021 https://www.thehindubusinessline.com/news/24x7-customs-clearing-fails-to-boost-trade-at-petrapole/article23638306.ece (accessed on 27 June 2023).

[29] op. cit, note-19.

[30] Sajid Karim and Gazi Quamrul Hasan, “Motor Vehicle Agreement between Bangladesh, Bhutan, India, and Nepal: Implications and Challenges, BIISS Journal, Vol. 36 (2), April 2015, p.175. Available online at file:///C:/Users/dell/Downloads/MotorVehicleAgreementBetweenBangladeshBhutanIndiaAndNepalImplicationsAndChallenges.pdf (accessed on 27 June 2023).

[31] Agreement for the Regulation of Motor Vehicle Passenger Traffic between India and Bangladesh. For details see Kolkata_Dhaka.pdf (morth.nic.in) (accessed on 27 June 2023).